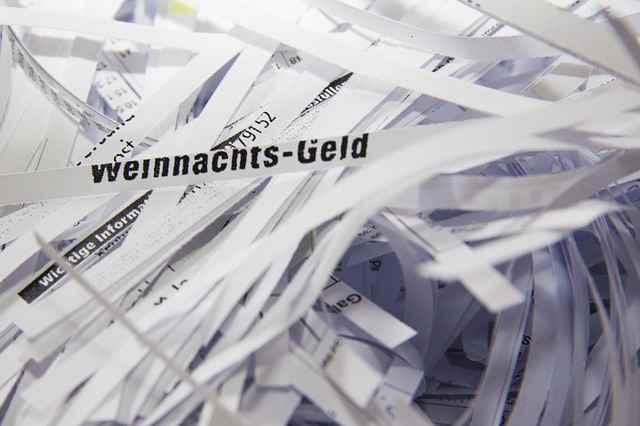

Learn what kind of documents you should be shredding.

All business owners must know that paperwork is not just a pile of documents- it is very important, and often personal, information that allows their business to function. There are many types of documents that need to be protected, and in most cases, that means that they should be digitally archived and shredded. Continue reading to learn the types of paper documents that should be scanned, securely backed up as digital files, then destroyed.

Employee Information

Any paperwork that includes employee information and personnel files should be shredded to protect your employees’ personal information. They will appreciate you for looking after their privacy and keeping their information safe.

Receipts and Invoices

While receipts and invoices may not seem like sensitive files, they can be used to find out about your business’s internal spending, overhead, data about business partners, and more.

Social Security Numbers

Social security numbers are extremely dangerous in the wrong hands, as they expose people to identify theft. Be sure to shred paperwork that contains this information and keep the digital files secure.

Medical Records

Medical records are very serious, as HIPAA regulations are very stringent when it comes to protecting someone’s medical information. Violations of these regulations can result in fines or even the loss of a medical practice license, so it is crucial to destroy these files.

Canceled Checks

Canceled checks pose a threat to business owners, as criminals can use them to create “new” checks and steal money from your company. In addition to shredding canceled checks, moving towards a paperless business is one major way to prevent theft.

Credit Card and Bank Account Numbers

Documents with credit card numbers and bank account numbers are often stolen from the trash by thieves. It’s crucial to completely shred and destroy these documents rather than just throwing them away. It’s best to start having all of your banking documents stored in a secure digital environment.

Tax Records

All tax records should be protected from getting into the wrong hands, especially W2 and 1099 forms. Keeps your files safe and secure with digital archiving and document destruction services from Micro Records.

Questions? Micro Records is Here to Help

If you have more questions about document management software, Micro Records is here to help you with all of your needs. We can help your business to transition to a paperless way of life with outstanding e-forms and technology. For more information about how we can help you implement your new document management software, visit us online or give us a call at 877-410-SCAN. For more tips, tricks, and to see what we have been working on, be sure to follow us on Facebook, Twitter, LinkedIn, and YouTube.